Market and regulatory pressures are at the heart of improving TPRM programs. There is a drive to more effectively identify and mitigate third-party risks before they impact the organization’s ability to deliver for its customers and maintain information security and operational continuity. It’s beyond time to get serious about TPRM program definition, comprehensive risk evaluations, actionable insights, automated workflows, and beneficial outcomes.

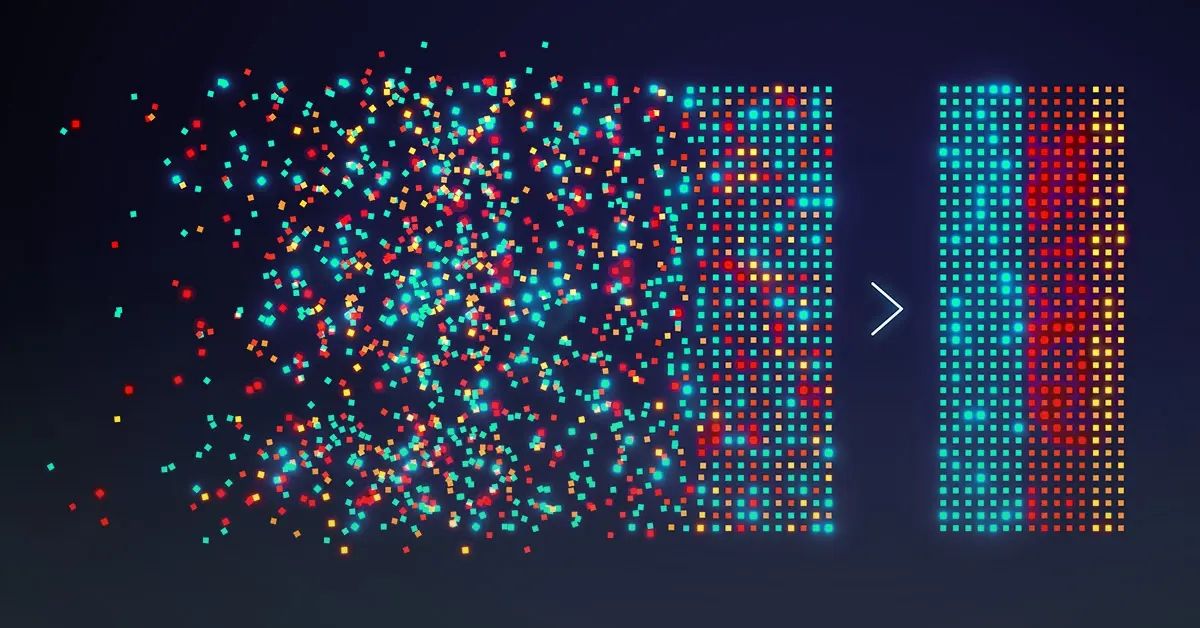

This is why Aravo’s Intelligence First™ platform and Evaluate engine have been designed and enhanced to deliver the highly actionable, configurable, and accessible risk evaluation and scoring that businesses need. In this regulatory and data-rich environment, how information works for you matters.

The Aravo Intelligence First platform is designed to deliver accurate and timely insights to risk professionals when and as they need them. By enabling the prioritization of risk intelligence in the qualification and onboarding processes, risk professionals can more accurately determine next step assessment and due diligence processes based on authoritative data and information related to a third-party engagement. The proactive integration of risk intelligence helps businesses reduce dependency on questionnaires and slow processes to risk-assess and onboard third parties. And the integration of Aravo’s Evaluate engine helps translate risk evaluations and scoring into action.

The Aravo Evaluate engine adapts and flexes with customer risk assessment and scoring needs, allowing for scoring ranges and granularity that help delineate and prioritize risks. Tested and proven by Aravo customers with (literally) millions of third parties, the Evaluate engine makes hundreds of risk-weighted calculations in real time, revealing risk stratification that delivers actionable insights.

Unlike any other available risk evaluation mechanism in the market, Aravo enables advanced understanding at scale. Aravo’s customer-defined scoring range and methodology allow customers to differentiate risk scoring to meet an increasingly diverse risk environment. This means each team can further express its risk urgencies on a singular customer-defined scale and understand the other’s perspective as well.

Ultimately, it helps centralized risk management teams and risk professionals better define why and where additional risk mitigation actions are required, to better allocate resources and spending, and to deliver more effective risk management programs.

The Aravo platform and Evaluate engine’s adaptable scoring range allows customers with separated TPRM teams to preserve existing scoring methodologies as they integrate into a single, centralized Aravo solution.

The vast adaptability of essentially limitless evaluation and scoring criteria allows for nuanced risk considerations particular to a risk domain to be imported into the Aravo environment. Customers face fewer blockers related to rebuilding their risk models as they consolidate into a single environment.

The Aravo Evaluate engine also allows customers to combine, separate, segment, or isolate risk scores for individual third parties, groups of third parties (by location, industry, function, etc.), or risk domains as needed. This allows customers to focus on and manage individual risk criteria as necessary based on their risk profile, risk landscape, and risk-based mitigation approach.

Where a third party may simultaneously represent compliance, operational, and elevated information security risk, the customer may combine or separate those risk scores as needed to best understand and manage their risks.

In that scenario, the customer has the option to aggregate the third party’s corruption, compliance, operational, and financial risks into one score and isolate the information security risks in another score. This allows customers to clarify relative risks and focus mitigation efforts as needed.

The capacity to capture and display historical risk scoring across the engagement lifecycle allows risk professionals to more easily track changes in risk, the impact of mitigation activities, and the evolution of the third-party engagement. Combined with the Aravo Intelligence First platform, the Aravo Evaluate engine empowers risk professionals with smart, actionable, and accurate information, driving program performance and maturity.

Watch Our Webinar to Learn How to Apply Risk Intelligence to Power Your TPRM Program More Effectively and Efficiently Than Ever Before

Contact Aravo to learn more about the newly enhanced Aravo Evaluate engine. Let us help you best manage your third-party risks and eliminate hidden and misunderstood risks from your supply chain.

Share with Your Friends: