A comprehensive risk assessment directly aligned to financial regulatory guidance and ready to integrate into your TPM program.

It’s designed for banks and other financial services institutions to rapidly stand-up a third-party risk management program with confidence that it is aligned to industry regulatory requirements, best practices, and expectations, derived and developed from regulatory guidelines.

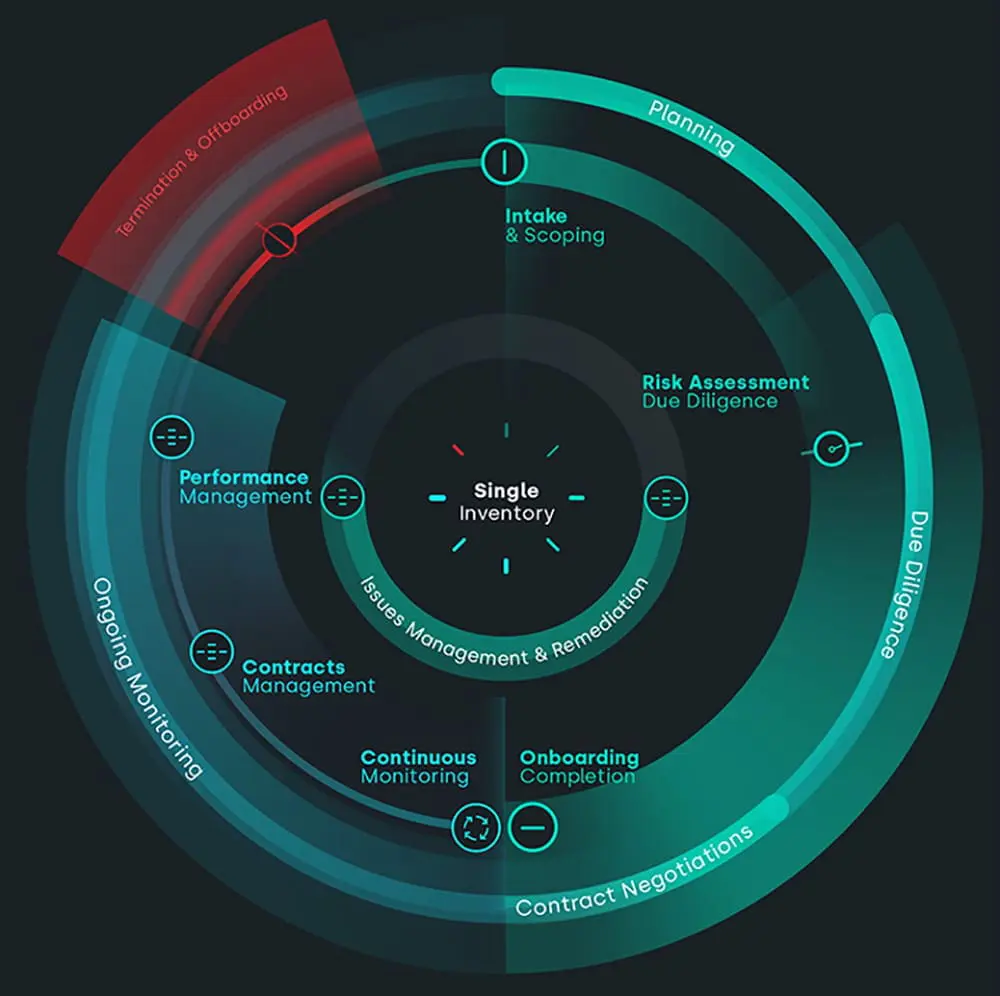

This third-party vendor risk management assessment for financial institutions can be customized to fit your organization’s needs and integrated into your TPRM program, providing you with a single system of record for all workflow processes.

Access an out-of-the-box risk assessment mapped to regulatory guidance

Adapt and make changes with ease.

Enjoy all the benefits of the Aravo for Third-Party Risk Management application.

Aravo offers the market’s most comprehensive set of capabilities for managing third-party, vendor, and supplier risk and performance, delivering supply chain risk management solutions that enhance operational resilience.

“We selected Aravo Solutions for their proven track record in supporting global, enterprise clients who have complex vendor risk management programs. With Aravo, our supplier risk management program and processes will be standardized across the firm and the technology will enable consistent governance and oversight of supplier risk and performance across the enterprise.”

– Gary Lock, Head of Supplier Risk & Relationship Management,

Fidelity International

“Best fit for our requirements, transparent and capability to handle greater volume of requests with ease. [The] Aravo technical team is very professional and supportive.”

– Process Lead,

Financial Services Firm

“Best fit for our requirements, transparent and capability to handle greater volume of requests with ease. Aravo technical team is very professional and supportive.”

– Process Lead,

Financial Services Firm

As one of the leading financial risk management software vendors, Aravo will get you better strategic results from your program and your third-party relationships. You can include the Financial Services Risk Assessment or integrate your current assessments. Benefits include:

Best practice capabilities to support the requirements of financial risk management software and services programs are pre-configured in the application.

Real-time reporting and complete auditability mean you can demonstrate compliance to the board, senior management, auditors, and examiners.

Centralize and standardize your third-party inventory and process controls with a single source of truth for all your third parties, critical third parties, and their subcontractors.

Easily extend and adapt as business conditions, policies, and regulations evolve.

Apply a standardized and defensible process for collecting, centralizing, and validating your third-party vendor information.

Ensure an objective, risk-based approach to third-party due diligence.

Deliver a consistent, automated process complete with a fully accessible audit trail. All your vendor information and documentation is in one place.

Create a centralized repository of all vendor contract information and automate contract monitoring, review, and management processes.

Continuously monitor vendor risk and performance and trigger review, escalation, issue management, and remediation activity.

Monitor third-party vendor performance, strengthen preferred supplier relationships, drive innovation, and eliminate poor performers.

Enable a systemic and consistent approach to issue management and identify, track, and manage third-party vendor issues from initiation through to resolution.

Ensure that the separation process is handled appropriately, including return of property and system access, assurance of data destruction, and notification to finance to cease payments.

Today, there is a maze of regulations, laws, and standards that companies need to consider as part of their compliance programs and to support industry best practice operations and conduct.